Donation & Pricing Policy

- Objective

To ensure transparency, accountability, and consistency in how donations are received, utilized, and acknowledged at ISKCON Whitefield, while upholding the spiritual sanctity of giving in devotional service.

- Scope

This policy applies to all types of contributions including:

- One-time Donations

- Monthly Recurring Donations (e.g., Nitya Seva)

- Festival Sponsorships

- Event-specific Contributions (Abhisheka, Annadana, etc.)

- Corpus and Endowment Donations

- In-kind Contributions

- Donation Categories & Suggested Amounts

|

Category |

Suggested Amount (INR) |

Frequency |

Purpose |

|

Nitya Seva |

₹ 1,000 |

Monthly |

Daily Deity services & prasadam |

|

Annadana (Food for Life) |

₹5,000+ |

As per donor |

Feeding the needy |

|

Festival Sponsorship |

₹10,000 – ₹5,00,000 |

Per festival |

Janmashtami, Rama Navami, etc. |

|

Goseva |

₹500 – ₹10,000 |

Monthly / One-time |

Cow protection and care |

|

Abhisheka Seva |

₹1,001 – ₹5,001 |

Per event |

Bathing ceremonies for the Deities |

|

Life Patron Membership |

₹36,666 (One-time) |

Lifetime |

Patron benefits & spiritual inclusion |

|

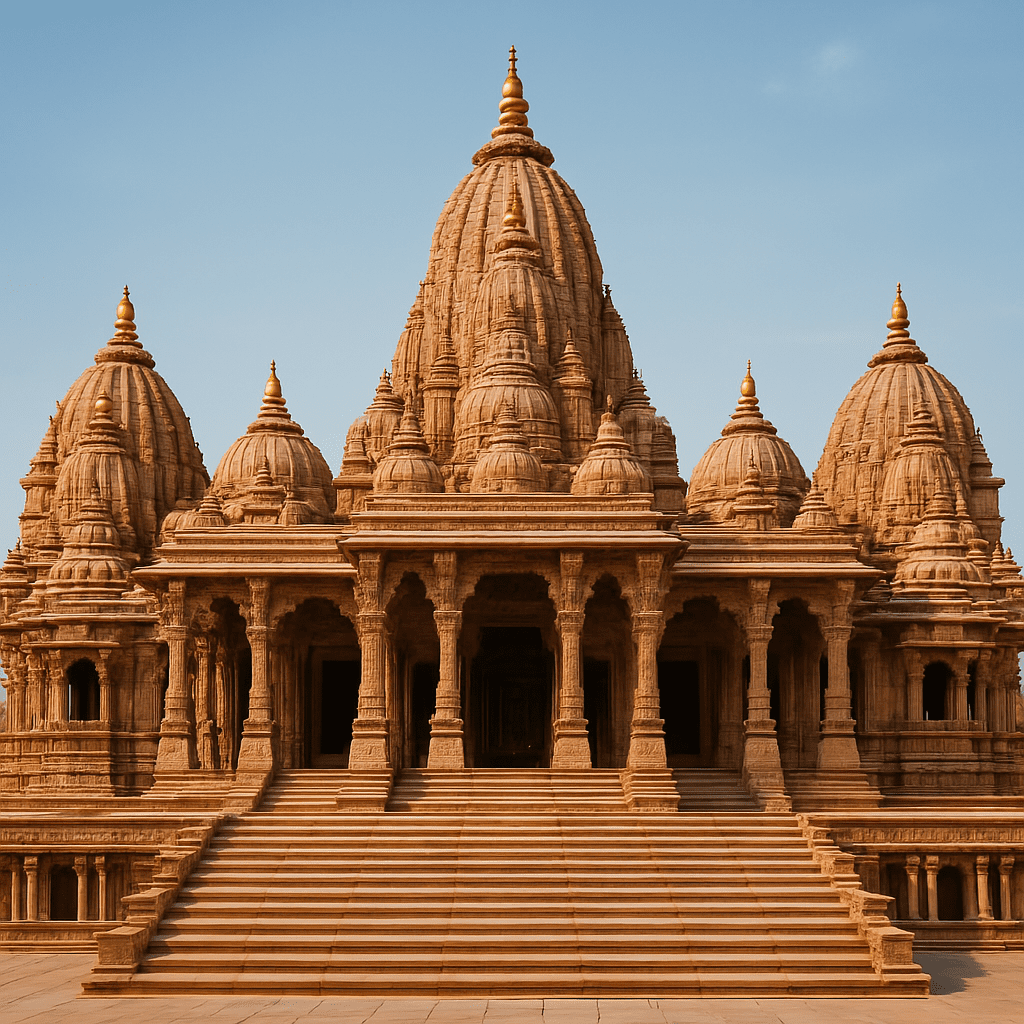

Temple Construction |

₹25,000+ |

One-time / Pledged |

Infrastructure & development |

|

Monthly Sankirtan Seva |

₹ 2,000 |

Monthly |

Book printing and distribution |

Note: These are suggested amounts. All donations are voluntary.

- Modes of Donation

ISKCON Whitefield accepts donations through the following channels:

- Online Portal (via official website / QR code / payment gateway)

- Bank Transfer / NEFT / RTGS

- UPI & QR Code

- Cash or Cheque (subject to receipt issuance)

- Donor Boxes at the temple premises

- In-kind donations (groceries, flowers, clothes, etc. after prior approval)

- Tax Benefits

- Eligible donations to ISKCON Whitefield are eligible for 80G tax exemption under the Income Tax Act, 1961.

- Donation receipts will be issued within 7 working days of receipt.

- Donors must provide PAN and contact details for tax exemption claims.

- Donor Recognition

- Major donors may be recognized via:

- Commemorative plaques

- Special blessings and mentions during festivals

- Invitations to donor appreciation events amongst others

- Donor names will not be commercialized or advertised inappropriately, in line with ISKCON’s spiritual values.

- Refund & Cancellation Policy

7.1 Donation Refund Policy

At ISKCON Whitefield, all donations are received with immense gratitude and are used exclusively for the intended spiritual, humanitarian, and community purposes. Since donations are voluntary and made for a charitable cause, we maintain a no-refund policy.

However, we understand that errors can happen. Refunds may be considered only under the following exceptional circumstances:

- Duplicate transaction: If a donor has made a donation more than once for the same cause or amount due to a technical issue.

- Incorrect amount entry: If an amount has been entered incorrectly and immediately reported.

- Unintended payment: If a non-donation transaction (such as registration or seva) was processed mistakenly.

To request a refund, please write to hariksetra.jps@gmail.com within 48 hours of the transaction, along with:

- Full name and contact number

- Date of donation and transaction reference number

- Reason for refund request

- Mode of payment and bank details

Refunds, if approved, will be processed within 14 working days via the same payment method used for the transaction. ISKCON reserves the right to deny a refund if the request does not comply with the criteria mentioned.

- Cancellation Policy

In the case of recurring monthly donations (auto-debit/NACH): Donors may cancel or pause their auto-debit as per their will.

Note

All refund decisions will be made at the discretion of ISKCON Whitefield’s Donation Oversight Committee. We humbly request all donors to verify the details before making contributions.

- Utilization of Donations

- ISKCON Whitefield is committed to responsible stewardship of donations.

- Funds will be used solely for temple operations, community service, deity worship, education, prasadam distribution, and outreach programs.

- Annual financial reports and audited statements will be available on request and shared with major donors.

- Governance

- The temple donation policy is monitored by a Finance & Seva Oversight Committee.

- Regular audits are conducted to ensure transparency and compliance with FCRA and income tax regulations.